Enphase Energy, Inc. announced today financial results for the first quarter of 2019, which included the summary below from its President and CEO, Badri Kothandaraman.

Highlights for the first quarter included:

- Revenue of $100.2 million; IQ 7 shipments at 94% of all microinverters

- Cash flows from operating activities of $17.1 million; ending cash balance of $78.1 million

- GAAP gross margin of 33.3%; non-GAAP gross margin of 33.5%

- GAAP operating expenses of $26.2 million; non-GAAP operating expenses of $22.3 million

- GAAP operating income of $7.1 million; non-GAAP operating income of $11.3 million

- GAAP net income of $2.8 million; non-GAAP net income of $9.5 million

- GAAP diluted EPS of $0.02; non-GAAP diluted EPS of $0.08

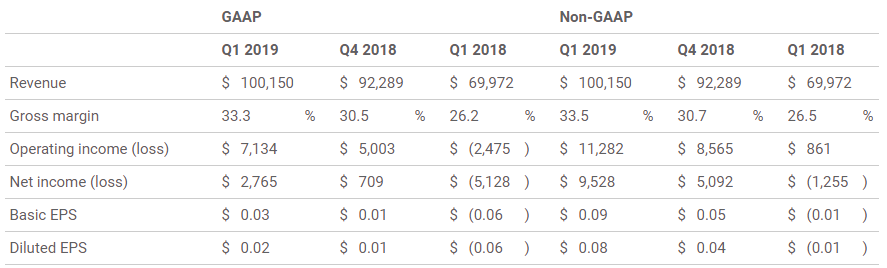

Our revenue and earnings for the first quarter are given below, compared with those of the prior quarter and the year ago quarter:

(In thousands, except per share data and percentages)

Our first quarter revenue was $100.2 million, an increase of 9% sequentially and an increase of 43% year-over year. We shipped approximately 306 megawatts DC, or 976,410 microinverters. We continued to see strong demand across the board from our customers, overcoming the typical first quarter seasonality in the solar industry.

We experienced component shortages which constrained our revenue in Q1'19. The capacity we paid for in May 2018 came online in Q1'19. We expect to get additional supply from our multi-year agreements for high-voltage power transistors; some of this supply is expected in Q2'19 and most of it is expected in the second half of 2019.

Our non-GAAP gross margin was 33.5%, an increase of 280 basis points from 30.7% in the fourth quarter of 2018. The non-GAAP gross margin was negatively impacted by 280 basis points due to expedite fees related to component shortages. The expedite fees were in the form of air shipments that we chose to make in order to service our customers. Non-GAAP operating expenses were $22.3 million, compared to $19.7 million in the prior quarter.

We exited the first quarter with $78.1 million in cash, net of the loan repayment to Tennenbaum Capital Partners in the principal amount of approximately $39.5 million, plus accrued interest and fees. Inventory was $13.0 million in the first quarter, compared to $16.3 million in the fourth quarter and $18.5 million in the first quarter of 2018.

Business Highlights

- On March 18, 2019, Panasonic Solar and Enphase Energy announced that the new Panasonic AC Series Photovoltaic (PV) HIT® N330E AC Module with integrated Enphase IQ™ 7X Microinverter is available for solar installation as of late March 2019. Panasonic's N330E HIT® AC Series Modules combine the efficiency of HIT® solar panels with Enphase's highly reliable seventh-generation IQ microinverters.

- On April 3, 2018, Enphase Energy announced that the Company released its updated Enphase AC Battery (ACB) with a new battery cell supplier and improved Time-of-Use (TOU) software for customers in Australia, New Zealand and certain parts of Europe. The new ACB system has an enhanced Battery Management Unit (BMU) designed to effectively monitor the health of the battery and increase the safety and reliability of the product. Enphase had previously shipped over 30MWh of residential energy storage systems to customers in Australia, New Zealand and Europe prior to the release of this updated ACB.

- On April 8, 2019, Enphase Energy announced that the Company entered into a multi-year supply agreement with Infineon Technologies AG for its power transistors developed using CoolMOS™ C7 Gold (G7) superjunction MOSFET technology. The agreement is expected to provide Enphase with an increased supply of high-voltage power transistors starting in the second half of 2019.

- On April 15, 2019, Enphase Energy announced that over 2,500 homeowners have joined the Enphase Upgrade Program, a service program that gives homeowners several options for upgrading to the latest, more efficient and reliable microinverter technology from Enphase. This program is for warranty holders of legacy Enphase microinverters and represents the Company's commitment to quality and service. Participation is entirely voluntary, and Enphase continues to stand by the warranties for its products in the field.

Second Quarter 2019 Financial Outlook

For the second quarter of 2019, Enphase Energy estimates both GAAP and non-GAAP financial results as follows:

- Revenue to be within a range of $115 million to $125 million

- GAAP and non-GAAP gross margin to be within a range of 32% to 35%

- GAAP operating expenses to be within a range of $25.0 million to $27.0 million, including a total of approximately $4.0 million estimated for stock-based compensation expenses, additional restructuring expenses and acquisition related expenses and amortization

- Non-GAAP operating expenses to be within a range of $21.0 million to $23.0 million, excluding a total of approximately $4.0 million estimated for stock-based compensation expenses, additional restructuring expenses and acquisition related expenses and amortization